Ethiopia's industrial parks are quietly emerging as the new frontier for global textile manufacturing, with Chinese companies leading a remarkable wave of investment that could reshape Africa's economic landscape. The transformation is happening at a pace that has surprised even the most seasoned industry observers, creating what many are calling the most significant shift in global textile production since China's own manufacturing boom decades ago.

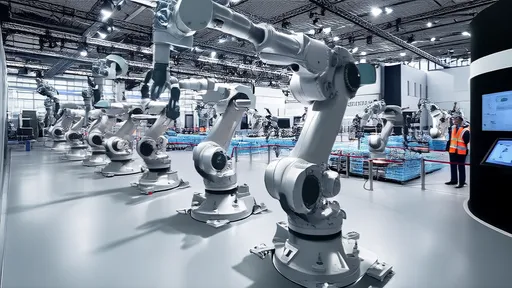

In the sprawling Hawassa Industrial Park, located 275 kilometers south of Addis Ababa, the hum of machinery has replaced the quiet of what was once agricultural land. Here, in what has been dubbed "Ethiopia's flagship industrial park," Chinese textile companies have established operations that employ thousands of local workers, producing garments for some of the world's most recognizable brands. The park represents just one piece of a much larger strategic vision that Ethiopia has been methodically implementing since the early 2010s.

The Chinese textile exodus to Ethiopia isn't happening by accident—it's the result of carefully calculated business decisions and strategic government partnerships. With labor costs in China's traditional manufacturing hubs like Guangdong and Zhejiang provinces increasing by approximately 15-20% annually over the past decade, Chinese manufacturers have been actively seeking alternative production bases. Ethiopia offers labor costs that are roughly one-fifth of China's, along with abundant young workforce—a crucial advantage in an industry that remains heavily dependent on manual labor.

What makes Ethiopia particularly attractive to Chinese investors goes beyond simple cost calculations. The country benefits from the African Growth and Opportunity Act (AGOA), which provides duty-free access to the United States market for thousands of products. This trade preference has become increasingly valuable amid ongoing trade tensions between China and Western markets. Additionally, Ethiopia enjoys preferential trade agreements with the European Union, making it an ideal export platform to multiple major markets.

The Ethiopian government has been remarkably proactive in creating the conditions for this industrial transformation. Through the Ethiopian Investment Commission, the country has established specialized industrial parks with pre-built factories, reliable electricity, and essential infrastructure. The government offers substantial incentives including income tax exemptions of up to ten years, duty-free import of capital goods, and streamlined bureaucratic processes specifically designed to attract foreign manufacturers.

Chinese companies aren't just bringing their machinery to Ethiopia—they're bringing entire production ecosystems. At the Eastern Industry Zone in Dukem, originally established by Chinese investors, the transformation is particularly evident. The zone hosts not only textile factories but also supporting industries including packaging, logistics, and maintenance services. This clustering effect creates efficiencies that individual factories operating in isolation could never achieve, making the overall operation more competitive in global markets.

The scale of Chinese investment in Ethiopia's textile sector has grown exponentially in recent years. According to data from the Ethiopian Investment Commission, Chinese companies accounted for approximately 60% of the total investment in the country's industrial parks between 2018 and 2023. The majority of these investments have been in textile and apparel manufacturing, with companies ranging from large conglomerates to specialized medium-sized enterprises establishing Ethiopian operations.

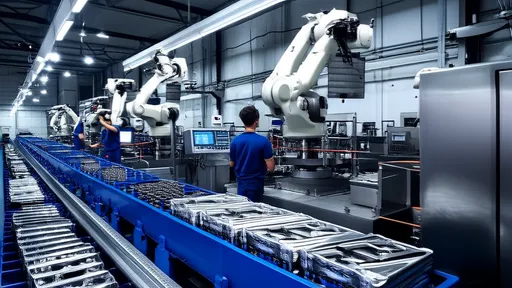

Training local workers has emerged as both a challenge and an opportunity in this rapid industrial expansion. Chinese companies have implemented extensive training programs, often bringing experienced supervisors from China to work alongside Ethiopian workers. While the initial productivity levels typically range between 50-70% of what companies achieve in China, most operations reach Chinese productivity standards within 18-24 months, creating a skilled workforce that becomes increasingly valuable to the country's industrial development.

Infrastructure development has been crucial to supporting this manufacturing migration. The Ethiopian government, often with Chinese financing and construction expertise, has been aggressively expanding road networks, improving port access through Djibouti, and enhancing power generation capacity. The Grand Ethiopian Renaissance Dam, when fully operational, is expected to more than double the country's electricity generation, providing the reliable and affordable power that energy-intensive textile manufacturing requires.

The environmental considerations of this industrial transformation have not been overlooked. The Hawassa Industrial Park incorporates an eco-industrial park concept with a zero-liquid-discharge wastewater treatment plant—the first of its kind in Africa. This environmental standard, while adding to initial development costs, positions Ethiopia as a responsible manufacturing destination at a time when global fashion brands face increasing pressure to ensure sustainable supply chains.

Challenges remain significant despite the impressive progress. Logistics costs in Ethiopia remain high compared to established manufacturing hubs, with transportation times to international ports sometimes unpredictable. The need for imported raw materials, particularly specialized fabrics and accessories, creates additional supply chain complexities. However, forward-looking investors are already working to develop local supply chains, with some Chinese companies beginning to establish textile mills to produce fabric locally rather than importing from China.

The relationship between Chinese management and Ethiopian workers has evolved into something more nuanced than a simple employer-employee dynamic. Many Chinese companies have implemented cultural exchange programs and adapted management practices to better suit local conditions. While cultural differences occasionally create challenges, the general trajectory has been toward greater mutual understanding and effective collaboration.

Looking forward, the momentum appears sustainable. The Ethiopian government continues to develop new industrial parks specifically designed for textile and apparel manufacturing, with several new zones in various stages of development. Chinese manufacturers, facing continued cost pressures at home and seeking to diversify geopolitical risks, continue to view Ethiopia as one of the most promising manufacturing destinations globally.

This manufacturing migration represents more than just a business opportunity—it's potentially transformative for both Ethiopia and China. For Ethiopia, it offers a pathway to industrialization that could lift millions out of poverty through job creation and skills development. For Chinese companies, it provides a strategic hedge against rising costs and trade uncertainties while positioning them as leaders in what many believe will be the next major chapter in global manufacturing.

The success of this partnership could have implications far beyond the textile industry. If Ethiopia can establish itself as a reliable manufacturing hub, it may attract investment across multiple sectors. Similarly, if Chinese companies can successfully transfer their manufacturing expertise to Africa, it could create a template for South-South cooperation that other developing nations might emulate. The factories rising from Ethiopian soil today may well represent the early stages of a fundamental reordering of global manufacturing geography.

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025