Morocco's automotive components industry has quietly transformed into Europe's second-largest supplier, marking one of the most remarkable industrial success stories of the past decade. What began as a modest manufacturing hub has evolved into a sophisticated ecosystem capable of competing with established European players. The North African kingdom now supplies major automotive brands across the continent, with its strategic positioning and competitive advantages creating an undeniable appeal for global manufacturers seeking reliable, cost-effective production partners.

The journey began in the late 1990s when Moroccan authorities recognized the potential of automotive manufacturing as a catalyst for industrial development. Initial efforts focused on creating specialized industrial zones with modern infrastructure and favorable regulatory conditions. The Tangier Med port, inaugurated in 2007, became a cornerstone of this strategy, providing efficient logistics connectivity to European markets. This infrastructure advantage, combined with Morocco's proximity to Europe and competitive labor costs, laid the foundation for what would become a manufacturing powerhouse.

French automotive group Renault's decision to establish a massive production facility in Tangier in 2012 proved transformative. The €1.1 billion investment created one of Africa's largest car manufacturing plants, capable of producing 400,000 vehicles annually. This anchor investment triggered a domino effect, attracting numerous component suppliers who needed to be located near the assembly lines. The presence of a major OEM created the critical mass necessary for developing a comprehensive supply chain ecosystem within Morocco's borders.

PSA Group followed Renault's lead, opening its own production facility in Kenitra in 2019. The French manufacturer's commitment further validated Morocco's position as a serious automotive manufacturing destination. These two automotive giants created the demand base that enabled local and international suppliers to establish operations in Morocco, knowing they would have substantial, stable customers for their components and systems.

The Moroccan government's strategic vision extended beyond simply attracting foreign investment. Authorities implemented comprehensive policies to develop local technical capabilities and create integrated industrial platforms. The emergence of dedicated automotive cities, particularly in Tangier and Kenitra, provided purpose-built environments where manufacturers could operate with maximum efficiency. These clusters fostered collaboration and knowledge transfer while reducing logistical complexities for companies operating within their boundaries.

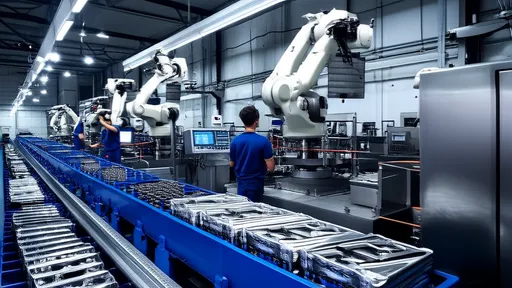

Morocco's competitive advantages extend beyond geographical proximity and cost considerations. The country has developed a skilled workforce capable of meeting the technical demands of modern automotive manufacturing. Technical training institutes, often established in partnership with industry players, ensure a steady pipeline of qualified technicians and engineers. This human capital development has been crucial in enabling Moroccan facilities to maintain high quality standards while adopting increasingly sophisticated manufacturing processes.

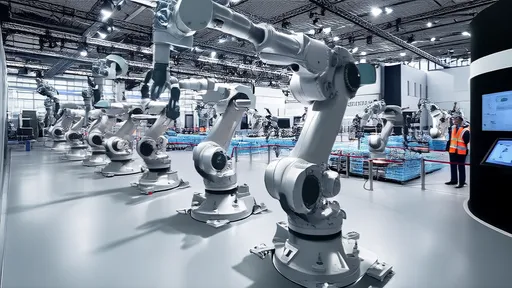

The industry's growth trajectory has been nothing short of impressive. From supplying basic components a decade ago, Moroccan manufacturers now produce complex systems including wiring harnesses, seating systems, automotive electronics, and engine components. The technological sophistication of local production has increased significantly, with many facilities implementing Industry 4.0 technologies and lean manufacturing principles. This evolution reflects the sector's maturation and its ability to meet the exacting standards of global automotive brands.

Morocco's automotive component exports have grown exponentially, reaching approximately $8 billion annually. The country now ranks as Africa's largest vehicle manufacturer and exporter, with the components sector representing a substantial portion of this output. More significantly, Morocco has surpassed several European nations to become the second-largest supplier of automotive components to the European market, trailing only Germany in terms of export volume to EU countries.

The sector's resilience was particularly evident during the COVID-19 pandemic, when Moroccan suppliers demonstrated remarkable adaptability in maintaining production and supply chain continuity. While many global manufacturing hubs faced severe disruptions, Morocco's diversified supplier base and robust logistics infrastructure enabled relatively smooth operations. This performance reinforced the country's reputation as a reliable manufacturing partner and prompted several companies to increase their sourcing from Moroccan suppliers.

Recent global supply chain challenges have further highlighted the advantages of near-shoring production to locations like Morocco. The automotive industry's reassessment of extended global supply chains has worked in Morocco's favor, with European manufacturers showing increased interest in sourcing from geographically proximate, politically stable partners. Morocco's free trade agreements with both the European Union and United States provide additional advantages, offering tariff-free access to these major markets.

The transition toward electric vehicles represents both a challenge and opportunity for Moroccan suppliers. Several component manufacturers have already begun adapting their production capabilities to serve the evolving needs of electric vehicle manufacturers. The country's established manufacturing base and technical capabilities position it well to participate in the electric mobility revolution, though continued investment in new technologies and skills will be essential for maintaining competitiveness.

Looking ahead, Morocco faces the challenge of moving further up the value chain while managing competition from other emerging manufacturing destinations. The government's Industrial Acceleration Plan aims to address these challenges by fostering innovation, enhancing workforce skills, and promoting research and development activities. Success in these areas will determine whether Morocco can consolidate its position as a strategic automotive manufacturing hub or face pressure from competitors offering similar advantages.

The Moroccan automotive components industry's rise exemplifies how strategic planning, infrastructure development, and targeted investment can transform a nation's industrial landscape. From humble beginnings, the sector has grown into a cornerstone of the Moroccan economy, providing employment for tens of thousands while establishing the country as a credible manufacturing partner for the global automotive industry. As the industry continues to evolve, Morocco's ability to adapt and innovate will be crucial for maintaining its hard-won position in the competitive global automotive supply chain.

Industry analysts predict continued growth for Morocco's automotive sector, though the pace may moderate as the industry matures. The ongoing global transition to electric vehicles and increasing automation in manufacturing present both challenges and opportunities. Morocco's established infrastructure, growing technical capabilities, and strategic partnerships position it well to navigate these changes, suggesting that the country's automotive success story has several chapters yet to be written.

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025