New Zealand's dairy industry, long synonymous with bulk commodity exports, is undergoing a profound transformation. The familiar image of milk powder being shipped in vast quantities is rapidly giving way to a more sophisticated narrative, one defined by innovation, specialized nutrition, and strategic market positioning. The most telling indicator of this shift is the sector's pivot towards high-value products, which now constitute over 60% of its export earnings. This is not a minor adjustment but a fundamental reimagining of New Zealand's role in the global food chain, moving from a volume-based supplier to a value-driven partner in health and wellness.

The journey to this milestone has been decades in the making. For much of the 20th century, New Zealand's dairy prowess was built on its ability to produce standardised commodities like Whole Milk Powder and butter efficiently and at scale. Its geographic isolation, once a challenge, became an advantage, allowing it to build a reputation for clean, grass-fed produce. However, the turn of the millennium brought new realities. Volatile global commodity prices exposed the vulnerability of a volume-centric model. Simultaneously, rising competitors, particularly in Europe and the United States, began to leverage their proximity to major markets. The New Zealand dairy sector, led by its cooperative giants and independent exporters, recognised that its future prosperity depended not on producing more, but on producing smarter.

This strategic evolution is most visible in the changing composition of the export portfolio. While milk powder remains a significant export, its character has changed. There has been a marked shift from basic powders to specialized Infant Formula and Medical Nutrition products. These are not mere commodities; they are scientifically formulated solutions that command premium prices. The success of New Zealand-made infant formula in markets like China and Southeast Asia is a textbook case of value creation. By leveraging the country's powerful "clean and green" brand, companies have positioned their products as the gold standard for safety and quality, allowing them to transcend the brutal price wars of the standard commodity market.

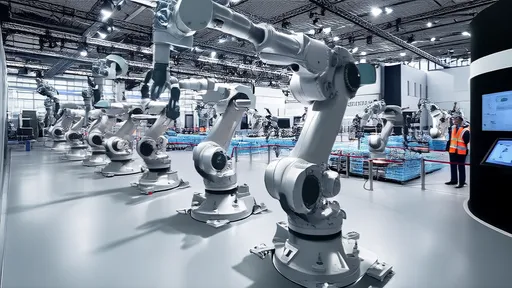

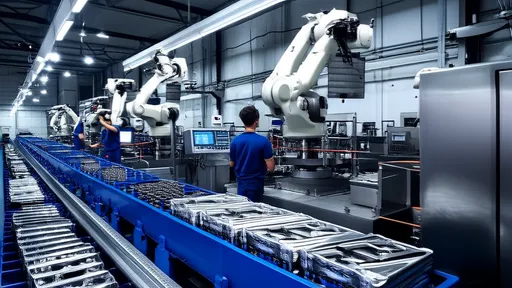

Beyond infant nutrition, the growth in other high-value segments has been equally impressive. Whey protein concentrates and isolates, once considered by-products of cheese manufacturing, are now star performers. Driven by booming global demand for sports nutrition, functional foods, and healthy ageing products, these proteins are the building blocks of a multi-billion dollar industry. New Zealand companies have invested heavily in advanced processing technologies to extract and purify these proteins, creating tailored ingredients for specific consumer needs. Similarly, the cheese category has evolved from exporting blocks of cheddar to a diverse range of specialty cheeses, artisanal varieties, and ready-to-eat snack products that cater to discerning palates worldwide.

The drivers behind this successful transition are multifaceted. At its core is a deep-seated commitment to Research and Development. Both the industry and the New Zealand government have poured significant resources into science and innovation. Crown Research Institutes like AgResearch and the Riddet Institute work hand-in-hand with dairy companies to explore new bioactive compounds, improve nutritional profiles, and develop novel processing methods. This scientific backbone enables the creation of products with proven health benefits, which is a key differentiator in the crowded global marketplace. It is this ability to translate pastoral farming into advanced nutritional science that forms the bedrock of the high-value strategy.

Market diversification has been another critical pillar of the strategy. While China remains the single largest market, the industry has worked assiduously to reduce its reliance on any one region. There has been strategic growth in North America for specialized ingredients, in Southeast Asia for consumer-ready nutritional products, and in the Middle East for Halal-certified dairy. This geographic spread acts as a buffer against regional economic downturns or trade policy shifts. Furthermore, companies are no longer just selling products; they are building brands and forging long-term partnerships with food manufacturers and retailers overseas, embedding themselves deeper into the value chain.

Looking ahead, the transformation is far from complete. The next frontier for New Zealand's dairy exports lies in the realm of precision nutrition and sustainability. The industry is exploring how to further tailor products for specific demographic groups, genetic profiles, and even individual health conditions. The concept of "food as medicine" is gaining traction, opening new avenues for clinically proven dairy-based interventions. Concurrently, the sustainability credentials of New Zealand dairy are becoming a product feature in themselves. As global consumers become more environmentally conscious, the country's grass-fed, free-range systems and ambitious commitments to carbon neutrality are powerful marketing tools that justify a premium and align with the values of modern consumers.

In conclusion, the fact that high-value products now drive the majority of New Zealand's dairy export revenue is a testament to a bold and successful sector-wide transformation. It is a story of moving up the value ladder, from selling raw ingredients to providing sophisticated nutritional solutions. This shift has not only fortified the industry against commodity price swings but has also cemented New Zealand's position as a trusted, innovative, and indispensable player in the global food system. The journey from the farm to the high-value export is a complex one, woven from threads of scientific innovation, market savvy, and an unwavering commitment to quality—a combination that promises to keep New Zealand dairy at the forefront for years to come.

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025